What is CETA and how to reap the benefits

This free trade agreement has become the talk of the town for businesses exporting to Canada.

What is CETA?

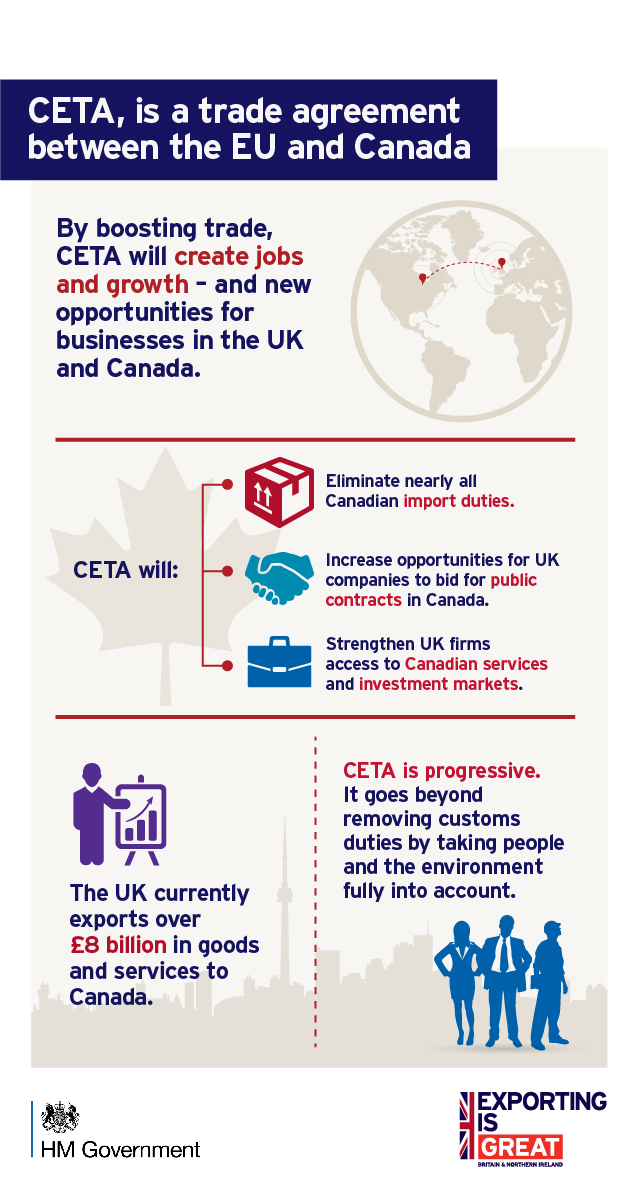

For businesses looking to export to Canada, the Comprehensive Economic and Trade Agreement (CETA) is a newly formed free trade agreement between the EU and Canada. The agreement was provisionally applied from 21 September 2017, meaning businesses can start reaping the benefits of exporting to Canada now.

What are the benefits of CETA?

According to Forbes, Canada is the second best country in the G20 to do business in, highlighting that a lot can be gained for UK businesses exporting to Canada.

98% of the duties (taxes) a UK company would have paid at Canadian customs have now been lifted. The same applies to Canadian businesses exporting to the UK. Eventually, all customs duties on industrial products will disappear completely, making UK exports more competitive on the Canadian market.

UK firms will also benefit from cheaper parts, components, and other inputs from Canada which they use to make their products, due to the decrease in import tariffs for goods coming into the UK.

CETA also allows UK businesses to bid for public procurement contracts in Canada, it makes it easier for UK firms to invest in Canada, and for UK professionals to work in the country.

What does CETA mean for my business?

With the elimination of nearly all tariffs, you may find it’s cheaper and easier for you to export your goods. A shared history, political system and language, also means Canada will be an accommodating environment to do business.

You can search your ‘Harmonised Commodity Description and Coding System’ (HS Code) on Canada’s Border Services Agency website to find out what the CETA tariff is for your product. By boosting trade, CETA will create jobs and growth – and new opportunities for your business.

New opportunities in the food and drink sector

CETA creates new export opportunities for UK farmers and producers of wines and spirits, fruit and vegetables, processed products, cheese and traditional specialities (known as ‘geographical indications’). Most customs duties on farm produce, processed foods and drinks have disappeared, and there will also be a substantial reduction in non-tariff barriers. For wines and spirits, CETA will also remove other barriers to trade, including a flat per litre charge from the liquor board service fees. This will make it easier for UK exporters to access the Canadian food and drink market.

The future of CETA

While the UK remains in the EU, it is subject to CETA’s provisions. Given the time needed to approve CETA in all EU Member States, there is a possibility that the UK will have left the EU by the time CETA comes fully into force. It has been suggested that if Brexit occurs after the full approval of CETA, the UK could be bound by its investment provisions for 20 years. Alternatively, the UK will arrange a trade deal with Canada; something Justin Trudeau, Prime Minister of Canada, feels confident is achievable after speaking with Theresa May in September 2017:

“The UK is the largest partner Canada has. CETA will form the basis for the way we move forward in a post-Brexit Europe. We are very confident we will be able to continue the strong trade ties and relationship with the UK throughout the period of transition.”